The world has evolved differently. What works for the western world may in most scenarios not work in the east. As a business, it is relevant you tap into the difference rather than trying to force an entire culture to adopt what you are used to.

The same thing applies to payments. You notice that the western world pays by Visa/Mastercard, The East (China) Prefers China Union Pay and Africa predominantly prefers to pay by Mobile money. As a business owner, it would make more sense to tap into the varying local preferred payment alternatives rather than expecting the world to pay you the way you are accustomed to in your region. Anything out of that would be detrimental to your business.

Here is what you need to know when choosing a payment service providers in Africa

- Africa has 54 different countries.

- Each of these countries has a different locally preferred mode of paying and accepting payments

- Card Payments account for less than 2% of all payments in Africa

Conclusion

As a business it becomes crucial you tap into Africa just the way it is. Choose a service provider that gives you the ability to seamlessly collect and pay out to multiple countries with one single integration.

With DusuPay here is a full list of payment alternatives you can accept payments from and Pay out to

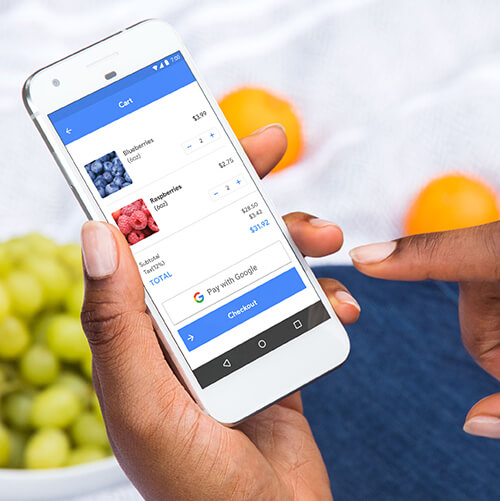

The shift of mobile payments is underway, especially now that people are being encouraged to pull out their smartphones instead of their old leather wallets every time they pay .With the help of dusupay payments can be effectively made. Below are all the countries in Africa together with their payment modes available for use on dusupay

UGANDA

Payment Alternatives available on Dusupay

a) MTN Mobile money. Market share; about 60%

b) Airtel money with a market share of about 35%

At the start, similar to other jurisdictions,the main services offered were funds transfer from person to person and storage of electronic value but the have since evolved to include many other services

KENYA

Mode of payment: MPESA

Market Share: over 90%

Kenya has an innovation and technology hub became the launching pad for Mpesa a transformative mobile phone based platform for money transfer and financial services.

From the time of the launch, Mpesa has undergone explosive growth accounting for over 43%of Kenya’s GDP in 2013 with over 237 million person to person transactions.

Transaction charges depend on the amount of money being transferred and whether the payee is ,a registered user of the service.the actual cost is a fixed amount for a given range of transaction sizes for example safaricom charges up to 66 kshs.for a transaction to an unregistered users for transaction between 101-500 kshs.(US$1-5)and 27 kshs. For a transfer to a registered user for the same amount.At the highest transfer bracket of 50,001-70,000 kshs the fee for the transaction to that can be transferred to a non-registered user fees are also charged. With a charge of 10 kshs,for a withdrawal of 50-100 kshs up to 330 kshs for withdrawal of 50,001-70,000ksh

CAMEROON

MTN Cameroon is the leading mobile operator in Cameroon providing mobile money services on which the following services are offered. This is available on Dusupay

TANZANIA

Modes of payment on DusuPay

a) Tigo Pesa

b) Vodacom MPESA

c) Airtel money

Collective Market share in TZ: 100%

In developing countries, mobile telecom networks have emerged as a major provider of financial services. In tanzania Tigo pesa,airtel money and vodafone mpesa are the major mobile money providers .mobile money is on the rise in tanzania in that a larger percentage of tanzanians have registered mobile money accounts and more are using them regularly in very many advanced ways, going beyond person to person transactions.giving a statistical evidence of 63% of tanzanians know of a mobile money agent within 1km of them and 22%of tanzanian adults save using mobile money

RWANDA

Mode of payment available on Dusupay: MTN mobile money

Here is some noteworthy information: Rwanda has also embarrassed mobile money through MTN through its MTN mobile money hence the following highlights

93%of adults have mobile money accounts

77% of adults in Rwanda have active mobile money accounts

62%active mobile money accounts holders are located in rural areas, while 72%lived on less than $2.50 per day

75% of active mobile money users pay bills through their accounts

NIGERIA

Payment Modes available:

a) online banking

b) Local cards including visa, mastercard and Verve

GHANA

Accepted Telecoms

- Airtel

- Globacom

- Vodafone

- Tigo

- Expresso

- MTN

Market Conerage

100%

SOUTH AFRICA

Online Banking from all South African Banks